Building a business from the ground up and turning an idea into a tangible reality is simultaneously exciting, challenging, and incredibly rewarding.

However, as your company evolves, so do your legal needs. From protecting your personal assets to navigating complex ownership structures, the right legal framework safeguards your business from legal pitfalls.

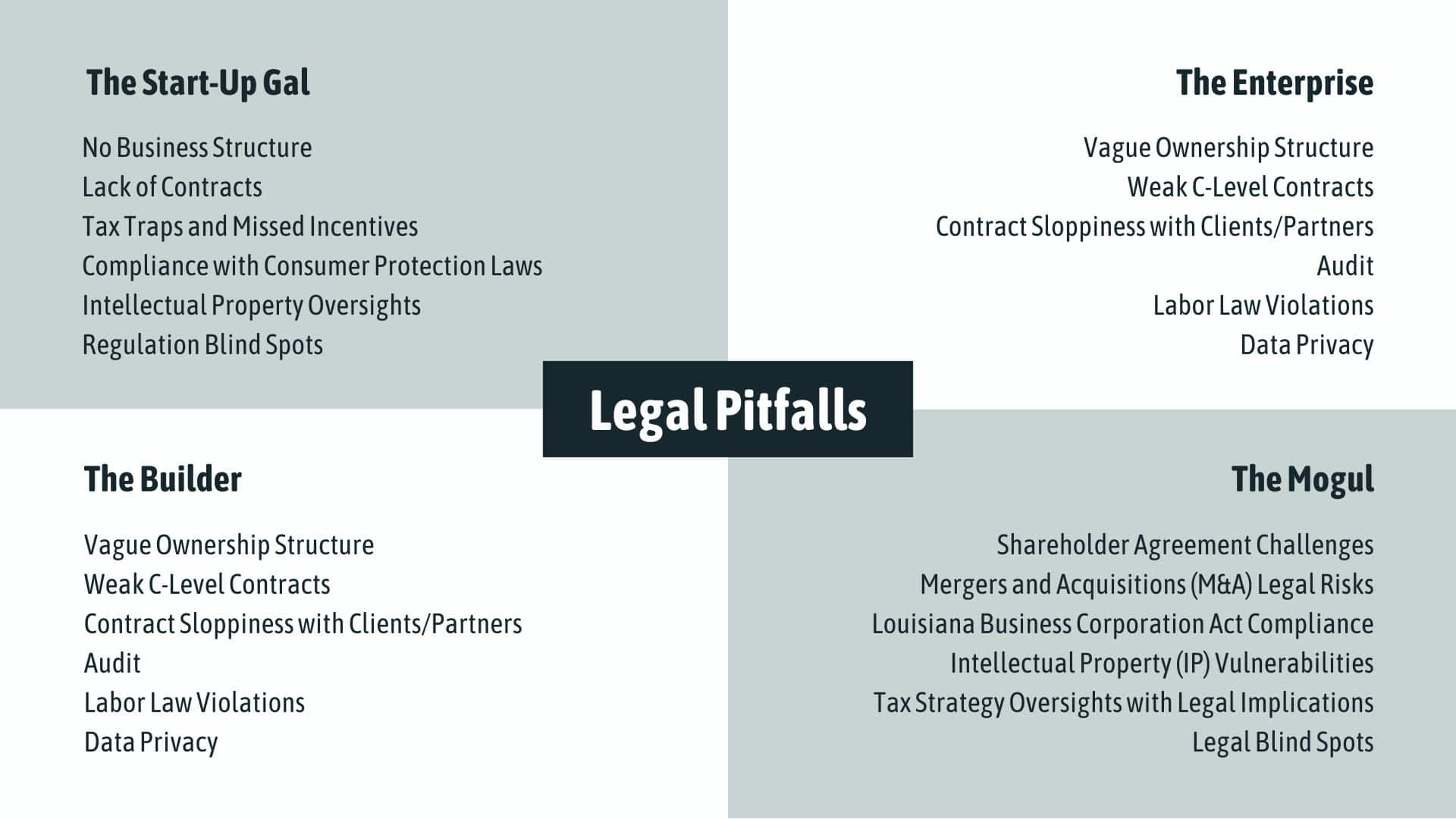

Let’s explore some legal must-knows for the four stages of business growth.

Legal Must-Knows for The Start-Up Gal

Someone just made an exciting leap into the world of entrepreneurship. Inspired by a mission, she poured her resources into starting her business.

At this stage, The Start-Up Gal’s main customers are her family and friends. She is a single business owner with no employees.

With limited resources, she prioritizes marketing and operations to attract customers and deliver quality service.

She may not have time to look into her business’s legal health.

However, legal missteps could haunt The Start-up Gal later on. Being accurate builds a strong foundation for startups to establish credibility, access funding, avoid penalties, and forge mutually beneficial partnerships.

Therefore, it is in the best interest of The Start-Up Gal to check on her legal health and learn her legal must-knows.

- Registering her business name protects her brand early on. She also needs basic contracts, like a client agreement to formalize transactions.

- Moreover, startups can benefit from various grants, loans, tax incentives, and specialized programming.

Legal Pitfalls

#1 No Business Structure

As a sole proprietor, The Start-Up Gal’s personal assets are on the line if the business gets sued. She should consider forming a Limited Liability Company (LLC). It’s a simple process that shields her personal property from business risks.

#2 Lack of Contracts

Selling to family and friends feels casual. However, without a basic client agreement, The Start-Up Gal is vulnerable to unmet expectations.

She should consider drafting a simple service agreement, outlining what she is providing, along with the payment terms and the refund policies.

#3 Tax Traps and Missed Incentives

Missing quarterly estimated tax payments leads to IRS penalties. Plus, The Start-Up Gal might overlook incentives like R&D tax credits.

#4 Compliance with Consumer Protection Laws

If The Start-up Gal is using a trade name, other than her legal name, she needs to register a “Doing Business As” (DBA) to comply with Consumer Protection Laws and bank requirements.

#5 Intellectual Property Oversights

Without trademarks, The Start-up Gal’s business could be stolen, or she could accidentally infringe on an existing trademark.

#6. Regulation Blind Spots

Certain businesses need special licenses or permits. Ignoring these could mean fines or shutdowns.

Legal Must-Knows for The Builder

The Builder’s business is pulling in $500,000 to $1 million in revenue. He has 1-2 key employees keeping things running. Still a single owner, he’s flirting with the idea of adding a co-owner.

Growth brings complexity. And now, more than ever, The Builder needs a Fractional Legal Counsel to deep dive into his vision and unique dynamics and tailor partnership agreements that maximize his business potential.

- The Builder needs to address profit sharing, dispute resolution, and exit strategies at the soonest opportunity for the best chance for success.

- If he brings in a co-owner, he’ll need a partnership agreement to define roles, profit-sharing, and exit strategies.

- With employees, he must comply with labor laws on payroll taxes, workers’ compensation, and employment contracts.

Legal Pitfalls

#1 Labor Laws

With 1-2 employees, The Builder is now responsible for healthcare and social security.

#2. Co-Owner Chaos

Bringing in a co-owner requires a rock-solid agreement covering profit sharing, roles, and decision-making to prevent disputes along the road.

#3 No Business Structure

If The Builder is still a sole proprietor, his personal assets are on the line if the business gets sued.

He should consider forming a Limited Liability Company (LLC). It’s a simple process that shields his personal property from business risks.

#4 Tax Headaches

A sole proprietor pays a high self-employment tax. This could be mitigated by R&D credits or by filing an S-Corp.

#5 Intellectual Property Gaps

Without trademarks or patents, competitors could rip off brand names, products, and processes that make a business unique.

#6 Regulatory Compliances

Selling on new platforms means a new set of compliances for The Builder.

Legal Must-Knows for The Enterprise

As a business grows into an enterprise, generating $1 million to $5 million, it becomes necessary to organize its human energy and establish a system to operate and solve problems.

As The Enterprise relies on C-level employees to manage operations, legal needs shift toward structure and scalability.

The Enterprise may subscribe to Small Business Advisor (SBA) to prevent legal pitfalls, anticipates real-world situations and address issues like profit sharing, dispute resolution, and exit strategies at the soonest opportunity to give it the best chance for success.

- All contracts must be clear and enforceable.

- Operation structure and ownership agreements have to be clear.

- Robust contracts for C-level hires, including non-compete clauses and confidentiality agreements.

- As revenue climbs, The Enterprise must navigate corporate tax filings, potential audits, and regulatory compliance.

- The Enterprise may benefit from tax exemptions and tax credits.

- Finally, The Enterprise needs to comply with labor, environmental, and investment regulations.

Legal Pitfalls

#1 Vague Ownership Structure

There should be a clear operating agreement with co-owners, investors, and partners to define voting power, profit splits, and dispute resolution.

#2 Weak C-Level Contracts

C-level execs like COOs and CFOs run the show. Ambiguous contracts leave The Enterprise exposed.

Non-compete agreements prevent a departing exec from launching a rival next door. Confidentiality clauses protect trade secrets.

#3 Contract Sloppiness with Clients/Partners

Ambiguous delivery dates or payment could mean lost revenue or litigation.

#4 Audit

Corporate tax filings are more serious as the IRS is likely to target The Enterprise for its higher revenue.

#5 Labor Law Violations

More employees means more compliance with labor laws and vulnerabilities in case of non-compliance.

#6 Data Privacy

Compliance with data privacy and other industry laws is a must to avoid hefty fines.

Legal Must-Knows for The Mogul

The Mogul’s business is a powerhouse. Exceeding $5 million in revenue, his focus has shifted from growth to stabilizing and diversifying.

The Mogul needs key people to manage businesses and departments. He values top talent and considers stock options to retain them.

The Mogul’s legal needs are forward-looking. He should not wait for legal problems to arise, but take a defensive approach by ensuring that all agreements are comprehensive and unambiguous — reducing loopholes that could be exploited.

Thus, he relies on Collective Counsel for legal expertise in various aspects.

- It is in the best interest of The Mogul to look into tax strategies.

- Offering stock options requires a formal equity compensation plan.

- If employees become co-owners, The Mogul will need a shareholder agreement, balancing their rights with his control.

- Mergers and acquisitions are on the horizon. Being accurate builds a strong foundation for businesses to establish credibility, access funding, avoid penalties, and forge mutually beneficial partnerships.

- Proper corporate governance, including the maintenance of books of accounts and submission of annual financial statements, is required.

- Finally, protecting trademarks, patents, and other intellectual property is essential to avoid disputes over corporate names or intellectual property rights

Legal Pitfalls

#1 Shareholder Agreement Challenges

A poorly drafted shareholder agreement can diminish the Mogul’s control of his company. Ambiguities in voting rights, dividend policies, or exit clauses might empower minority shareholders to challenge his decisions.

#2 Mergers and Acquisitions (M&A) Legal Risks

Inaccurate due diligence during M&A could expose The Mogul to hidden liabilities.

#3 Louisiana Business Corporation Act Compliance

Non-compliance with the Louisiana Business Corporation Act (LBCA) could lead to fines or loss of good standing. Maintain accurate books, file annual financial statements, and secure local permits.

#4 Intellectual Property (IP) Vulnerabilities

Failing to protect technologies and patents could threaten the brand.

#5 Tax Strategy Oversights with Legal Implications

Sloppy tax management could trigger audits or fail to maximize tax strategies.

#6 Legal Blind Spots

Waiting for issues to surface before addressing them could leave The Mogul vulnerable to evolving regulations or industry-specific laws.

The Bottom Line

As your revenue climbs, so do the stakes. Invest in your legal foundation early, satisfy your legal must-knows, and adjust it as you scale—it’s the backbone of a business built to last.